That Retired Guy (TRG) is a refugee of the world of high finance. His career spanned 15 years mostly in New York and London. TRG saw a lot in those 15 years. Most of that time, finance was a celebrated industry, and in the glory days, it was hard not to swallow some of the cool-aid. Now, with the benefit of hindsight, TRG can see that the rot had started long before the crisis of 2008 exposed it to the outside world. Like a zit on the face of the globe, the puss built up below the skin even when the outside world thought everything was beautiful. When the painful zit-head finally appeared, the full extent of the problem was still hidden. But when agitated, the puss exploded everywhere. Of course, this 'zit' analogy only really works if you've seen John Bolushi's zit joke in the movie Animal House. That's the short story of the downfall of finance in the last 20 years (put in terms that any adolescent can easily understand). For anyone interested in what really happened, read on.

It Started With a Little Lie About Efficient Markets

This story starts a few years (maybe a decade) before TRG hit the financial scene. At the time (and even today to a certain degree) the Efficient Market Theory was seen as a hard to refute fact. Those in the world of Finance certainly were (most still are) big believers. Bankers then and now often fall back on the idea of Efficient Markets as a raison d'être. The logic goes something like this: the market is efficient, so if someone is paying for a financial innovation, then it must be valuable to them, and by extension society overall. Loyd Blankfien famously pushed that button when he said he Goldman Sachs

was doing "gods work". The idea Loyd was hitting on was that financial

innovation was making the world of capital allocation more efficient,

and this increased efficiency was a benefit to all humanity. This is of

course, NONSENSE, but it's that dangerous sort of nonsense that sounds nice, and is easy to follow.

After what we have experienced in the last 3.5 years (and are still experiencing today) the idea that financial innovation is making the world better should be a hard sell, but it seems some people still take it for granted. The academic debate will rage for years. Academia is particularly fond of the idea of Efficient Markets, but the theory actually suggest that corruption and fraud are market inefficiencies which will be resolved 'naturally' as long as markets are free and transparent. Anyone who has ever worked in an investment bank knows that 'transparent' financial markets are a useful illusion used to distract the client's attention while you get extra revenue from some part of the process that is left surprisingly opaque.

The truth is that the world of finance is subject to fashion, trend and hype; in fact, it seems that most every human endeavor is. Years of calm markets created a complacent public who believed that the smart folks in finance had finally figured out how to create profitable, never ending stability. Opaque, hard to analyze products, aggressively sold by bankers who present an illusion of providing an 'inside track' came in contact with a willing public allowing the promise of quick profits to dampen their natural skepticism.

Banks create new products because they can SELL them. This statement seems painfully obvious, but it deserves a deeper look. Note that the only important aspect is that a sale can be made, not that the sale is beneficial for the client. Efficient market theory tells us that the sale itself is evidence that the product is beneficial, but TRG has witnessed first hand that the benefit of the client is a secondary concern to the banker, and in fact, it is often absent.

Paul Volcker hit the nail on the head when he said that the only useful financial innovation in the past 25 years was the ATM. Lord Adair Turner said that most financial innovation was "socially useless" which is probably being generous because it does not account for some innovation actually being socially damaging. TRG has a humble idea that he believes will easily illustrate that the growth in the finance industry is NOT improving the world. It's a simple idea, the premise is this: if the financial industry is good for the world then growth in financial profits should be matched in overall corporate profit growth, and in fact global GDP growth.

The Finance Industry is Actually a Tax on Investment

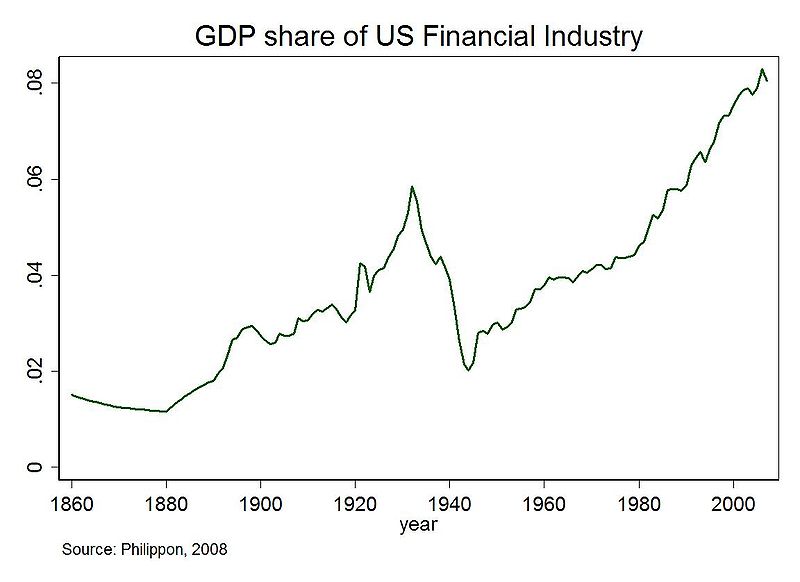

Finance is a service, and ideally, it is a contributing service to other useful economic activity. However, finance is a specific kind of service, at it's core, the job of the financial industry is simple: take excess capital (savings) and deploy it in useful ways (investment). Finance moves money from savings to investment, and takes a little slice of that money as a fee for the service. The fee is an important element here because in a perfectly efficient system savings and investment would come together without the need for a financial industry to help them. When finance takes it's fee, what is really happening is that a small amount of investment money is leaking out of the system and resulting in less investment then if the investment had happened without the financial industry getting involved. In a way, the financial industry's cut can be seen as a sort of 'tax' on investment. Everything is fine with that, if the financial fee (tax) is really compensating for a truly enabling activity, then it is worth paying. Over time, this should become evident because when financial fees increase, overall economic activity that they are promoting should increase more. The problem is that in fact, the finance industry has been taking a bigger and bigger slice of the pie. TRG doesn't have the global numbers, but he was able to find the numbers for the US (courtesy of wikipedia who sourced it from here):

Unfortunately, the global equivalent of this graph is required to prove the point. Back in the day when This Retired Guy was That Working Guy, he could have grabbed this data from his Bloomberg terminal (maybe not going back 150 years, but certainly they have some data) to show the same trend. TRG would really appreciate if one of his readers is plugged into a Bloomberg terminal and can help.

The global numbers are necessary because the above graph could result from the US doing more finance for OTHER countries. TRG doesn't think that's really what's happening here, but until we see the total global financial industry graphed as a percent of global GDP the jury is still out.

Assuming the global graph looks something like the above graph, then it would be a pretty damning indictment of the finance industry. The fee (tax) going to finance has gone up from less then 2% of economic activity to nearly 8% in the United States in the last 150 years! In itself, this graph does not prove that finance is bad, but it does say that at very least, finance is becoming much LESS effective at helping economic activity then it was. That should be surprising, after all, the banking industry benefited greatly from improvements in computers, and telecommunication over this time. Why has finance not become more efficient at it's central job of enabling investment?

The Masters of the Universe Have Taken Over

Most of the money that the finance industry earns (from taxing investments) goes to pay staff, compensation ratios (percent of pay to overall revenue) very but generally run 30 to 40%. This is not surprising in itself, but when you couple this fact with the revelation that the financial industries revenue is actually a tax on investment, then it starts to become clear how we got into this mess.

In TRG's time as a finance employee, he saw the industry increasingly attracting the smartest and most driven individuals with the promise of ever increasing pay. When a bright young graduate was being hired, there was an implicit bargain being offered. The bank was basically saying "find a way to increase the tax on investment, and we will share the profit with you". The banks thought they were getting a good deal, but in fact, they missed an important element. The easiest way to increase revenue in finance is to increase risk.

Increasingly, the banks have modeled their culture as a meritocracy. "Make more for the bank, and you will make more for yourself" or in banker jargon "eat what you kill" is an obvious part of that, but pay is only one aspect of the industry's obsession with rewarding on 'merit'. Promotion to management increasingly worked on the same principal. Meritocracy seems like a great way to run a business, but in fact, it has some drawbacks. First, it is critical that the analysis of performance is accurate, and that there is little chance that they system will be 'gamed'. Second, if different job's require different skills, then the 'The Peter Principle' can become a real thing. The Peter Principle is the idea that in a meritocracy, each individual will be promoted until they reach a level where they are incompetent, and there they will remain unable to achieve further promotion. This is particularly troublesome in banking where, for example, the personality traits which seem compatible with successful traders are disastrous when employed in management.

In the golden years, the hyper competitive environment, and difficult working conditions came with a fat paycheck around Christmas time. The personalities that excelled in this environment created a culture which became less and less human, and more ruthless in it's drive for maximum reward. TRG remembers well the common refrain whenever a high flying trader was confronted with anyone who didn't agree with them, or do what they wanted... these individuals had a name in the trader's mind, they were called 'Fucking Idiots'.

When the fire-hose of profits was spraying far and wide, none of this seemed to be an issue, it was even glorified. Financial industry employment itself became a fashion. This process was

already well underway when TRG started, but then it really took off. When we say 'banker' today, we envision slick Wall Street types in expensive suits.

The banking crisis of 2008 was a direct result of this culture, and the result was inevitable. Of course, mortgage securities packed with sloppy underwritten loans paid their part, but if it hadn't been Synthetic CDO's then the slick bankers would have come up with something else.

We Need to Get Back to the Old Style Banker

This vision of the modern banker would sound very strange to a man on the street in the 1950's, or in fact, most of history. Historically, banking has been a conservative boring career; a bit like being an accountant but not quite as exciting. This is in fact what banking should be; boring. Bankers should be hyper conservative rather then hyper competitive. They should be custodians of wealth who pride themselves at saying 'no' to everything except the most solid investments. Innovation should be a dirty word in finance! The economy will not grow as fast, but it will be more stable. Today's stereotypical banker is the real reason that things went wrong. Fortunately, the flashy high flying banker of today is an anomaly, not a permanent evolution. The industry is already showing signs of change, but this is just the beginning. The adjustment has started; the old banker is coming back. It took decades for things to get this messed up, so it is going to take time to make it right, and it wont be easy.

Getting to the Old Style Banker Will Be No Fun For the New Style Banker

For the modern day financial professional, this adjustment is going to be particularly painful. They were sold a promise that is no longer valid. There is now pressure to reduce pay and pay is coming down, but the culture change has not even begun, in fact, the culture has become even more poisonous. As the revenue has come down, most of the big banks have also cut back on staff as well as pay. The jobs have not become any less intense, but now there are fewer people to do them. In fact, with the wave of regulation (Dodd-Frank and Basel III to name just a few) the workload has dramatically increased.

There was a fair amount of truth in the old stereotype of banking jobs being unbearably stressful and intense, but justified by the high compensation. That was the old stereotype, now the stereotype is of a job that is unbearably stressful, intense, surrounded by backstabbing assholes, and providing an ever shrinking paycheck. Since staffing levels are down at most banks, this increased work is falling on the remaining employees, at a time when the big compensation packet is no longer in the cards. TRG had his own reasons for leaving the finance industry, but he knows many who are heading for the exit now for this reason.

As the pay pools have dried up, the hyper competitive staff have become increasingly preoccupied with grabbing recognition for anything that has generated positive revenue, and avoiding any work that distracts from increased revenue generation. Naturally, if anything goes wrong, then shifting blame has also become a critical professional skill. What was once a team oriented focus on getting the job done has increasing become an environment of constant witch hunts, and passing the buck. In the last years of TRG's career, he noticed that it was increasingly not good enough to get someone to agree, it had to be written in an e-mail correspondence somewhere because the agreement or promise was likely to be reneged later. The environment was always high pressured, but when you get to a point that people can't be trusted to keep there word, it's really no fun!

In TRG's humble opinion, this is how the world ends for the modern day banker. The job will end because the culture has slowly poisoned itself on it's own glutenous behavior. Bankers are already leaving the industry like rats from a sinking ship (exactly like rats actually). It will take time, but eventually, banks will become boring places full of people who seem to pride themselves on their conservative, bureaucratic routine. 'Banking Innovation' will once again be an oxymoron.

No comments:

Post a Comment