Long time readers (ok, there are none... I admit this is the least popular blog on the internet) will know that I've been looking at France as the real tipping point for the crisis see here, here and here. In fact, it's a shame that nobody seems to read this blog, because That Retired Guy (TRG) has been pretty good at predicting the crisis (just a little early on most of his calls).

Recent events as well as this brilliant cover on the Economist bring TRG welcome vindication.

As if on cue, immediately after the above was published, Moody's came out with a downgrade on Frances debt. S&P already made that judgement, but that mattered less for two reasons.

First, S&P had already lost any credibility that might remain when they botched the US downgrade. Of course saying S&P is the least credible of the rating agencies is a bit like saying they are the worst wreck in the junk yard, but it made it possible to completely blow them off rather then giving some short consideration.

Second, for any institutions that use credit ratings in their investment criteria, the rules are generally structured such that when the agencies disagree then the outlier is discarded (up until now, the outlier for France was S&P). Of course investment criteria everywhere are a bit of a joke, and can always be changed (or completely ignored) if the investor decides. For a great example, look at the ECB and their collateral criteria which used to rely on rating agencies until the agencies inconveniently started marking down European sovereign debt. At that point, the ECB promptly changed the requirements so the debt of Europe's sovereigns would continue to function as collateral. A bit like a parent who can't get their kid to come home on time, and fixes the problem by setting a LATER curfew.

So what now? That depends, it is still possible to blow off the ratings agencies, and ignore the Economist (and those other haters in the press). France's bonds are still priced at RIDICULOUSLY low levels. They have started to creep up this week, but they have a long way to go. The 10 year bond in France is currently at 2.15%, and it will not gain much attention unless it raises above 3.5% quickly.

The crisis may not kick off for France until the January or February, but something important has still happened this week. This is the week that the ball gained momentum, not much, but more momentum then Hollande's government is likely to control. It's not out of control yet, but it's on a track with few likely detours and a big catastrophe at the end. Sure the track is long, probably longer then we can guess, but does that really matter when we know what's at the end?

Commentary on Finance, Economics, and whatever That Retired Guy wants to talk about.

Wednesday, November 21, 2012

Thursday, November 15, 2012

Fault Lines - What's Now

There's not really much to say in the Fault Lines department. Things seem to grind along without much better or worse. This should certainly be NOT be taken as an indication that the crisis is over, or even ending, however the probability that we are able to grind along back to normality has increased. In some ways this is a shame. Grinding along to normality may take 10 to 15 years, and there must be a quicker way to heal the wounds and move on. TRG is going to take a break from the Fault Line predictions, but the following issues will still interrupt his sleep:

Public Revolt

Spain, Italy and Portugal staged major strikes yesterday, and the public mood across Europe has turned decidedly against austerity. Regardless, every batch of politicians plays from the exact same script. There exists an extremist fringe in Europe, but up until now they have not been able to front a leader who can effectively rally the masses. Will the extremists produce a movement before the standard politicians bumble their way out of the debt mess?

Crisis Spread

The real frontier of the crisis is not Spain or Italy, it is the UK, France and even Germany. Take the UK first, the shrinking in the financial sector is putting a major drag on London, and since London is the last bright spot holding a very shaky housing market together, things do seem likely to get a bit worse. France is full of problems, Hollande is losing credit with his people fast even though he has been pretty good at threading his way through a hopeless situation. What's wrong with Germany? First off the population thinks they are economically superior to the rest of Europe, and that sort of overconfidence can make for painful realizations. Germany's state banks are not particularly stable, and even the great Deutsche Bank is pretty threadbare when it comes to capital.

Crisis on Entirely New Front

The world is shaky right now. The US is facing another political crisis, Japan is realizing that a lost decade is actually starting to look like a lost future. China is going through a change of guard. There's potential for problems everywhere.

Public Revolt

Spain, Italy and Portugal staged major strikes yesterday, and the public mood across Europe has turned decidedly against austerity. Regardless, every batch of politicians plays from the exact same script. There exists an extremist fringe in Europe, but up until now they have not been able to front a leader who can effectively rally the masses. Will the extremists produce a movement before the standard politicians bumble their way out of the debt mess?

Crisis Spread

The real frontier of the crisis is not Spain or Italy, it is the UK, France and even Germany. Take the UK first, the shrinking in the financial sector is putting a major drag on London, and since London is the last bright spot holding a very shaky housing market together, things do seem likely to get a bit worse. France is full of problems, Hollande is losing credit with his people fast even though he has been pretty good at threading his way through a hopeless situation. What's wrong with Germany? First off the population thinks they are economically superior to the rest of Europe, and that sort of overconfidence can make for painful realizations. Germany's state banks are not particularly stable, and even the great Deutsche Bank is pretty threadbare when it comes to capital.

Crisis on Entirely New Front

The world is shaky right now. The US is facing another political crisis, Japan is realizing that a lost decade is actually starting to look like a lost future. China is going through a change of guard. There's potential for problems everywhere.

Tuesday, October 9, 2012

Revisiting Apple

It's been a while since That Retired Guy (TRG) has commented on Apple. In the time since the last post, Apple had a mildly disappointing quarter, and released a new version of the the iPhone. The iPhone re-design is a particularly big deal because it is the first major re-vamp post Steve Jobs. First impressions are that it's not earth shattering, but it is probably good enough for Apple to continue selling as many of them as it can make for the next few quarters.

The change from Google Maps on the iPhone has been a major hiccup, but is probably not a fatal flaw. If Apple really throws their development weight behind the new mapping app, then they can probably fix most of the issues by the next release, and longer term, owning the mapping tool will be positive for Apple. As great as Google maps are, the fact is that they have left the door wide open on this feature, and there is plenty of room to do it better. Having a unique mapping application on Apple products gives one more opportunity to pull user's into the 'Apple Ecosystem', and any Apple user will tell you that once someone starts using Apple products they quickly (and happily) become 'locked in'.

TRG came across a very interesting article yesterday. Apparently, Toni Sacconaghi at Bernstein Research (one of the better Wall Street Research firms) believes that 70% of iPhone 5 purchases are coming from NEW USERS and not upgrades. TRG finds this a little hard to believe, but if it's true, it's really bad news for Google and Samsung because Apple users are very loyal, and not just because the products are good. Apple creates loyal users because the products work together in a seamless way, and users become comfortable, and dependent on the features.

The iPhone will have a limited impact on this quarter, but it MAY be enough to bring Apple's yearly profit to 44 Billion. That would place them in the top 5 in the list of largest earnings ever, and there's still an outside chance that they will make number 1 on the list this year. For those who want to measure the historical greatness of Apple, this is the list to pay attention to. The press has spilled a lot of ink on the fact that Apple's market capitalisation has made it the 'most valuable company ever'. Even though on an inflation adjusted basis, Microsoft still holds the title. The fact is that market capitalization really doesn't mean much. When Microsoft topped the list, it was no where near as profitable as Apple is today. In fact, Microsoft's highest earnings do not even place them in the to 20 of highest earnings of all time. Microsoft rode the tech bubble to an inflated market value, while Apple continues to trade at a very modest 15 times earnings.

Is AAPL stock as good of an investment as it was a year ago? No, the stock price growth has started to match (even exceed) earnings growth. But at 15 times earnings, AAPL is still a pretty good deal. Apple will struggle to keep up with demand for the iPhone in the next quarter, and if the rumors are true of a new iPad mini, then they will likely continue to increase profits. Most analysts forecast growth greater then 20% for next year, and TRG does not see any major issue with Apple meeting or exceeding that target.

Longer term, it's harder to say. Apple's products are by far the best designed consumer electronics, but it is always hard to stay on top when everyone is gunning for you. Can Apple create the next big thing without Steve Jobs?

The change from Google Maps on the iPhone has been a major hiccup, but is probably not a fatal flaw. If Apple really throws their development weight behind the new mapping app, then they can probably fix most of the issues by the next release, and longer term, owning the mapping tool will be positive for Apple. As great as Google maps are, the fact is that they have left the door wide open on this feature, and there is plenty of room to do it better. Having a unique mapping application on Apple products gives one more opportunity to pull user's into the 'Apple Ecosystem', and any Apple user will tell you that once someone starts using Apple products they quickly (and happily) become 'locked in'.

TRG came across a very interesting article yesterday. Apparently, Toni Sacconaghi at Bernstein Research (one of the better Wall Street Research firms) believes that 70% of iPhone 5 purchases are coming from NEW USERS and not upgrades. TRG finds this a little hard to believe, but if it's true, it's really bad news for Google and Samsung because Apple users are very loyal, and not just because the products are good. Apple creates loyal users because the products work together in a seamless way, and users become comfortable, and dependent on the features.

The iPhone will have a limited impact on this quarter, but it MAY be enough to bring Apple's yearly profit to 44 Billion. That would place them in the top 5 in the list of largest earnings ever, and there's still an outside chance that they will make number 1 on the list this year. For those who want to measure the historical greatness of Apple, this is the list to pay attention to. The press has spilled a lot of ink on the fact that Apple's market capitalisation has made it the 'most valuable company ever'. Even though on an inflation adjusted basis, Microsoft still holds the title. The fact is that market capitalization really doesn't mean much. When Microsoft topped the list, it was no where near as profitable as Apple is today. In fact, Microsoft's highest earnings do not even place them in the to 20 of highest earnings of all time. Microsoft rode the tech bubble to an inflated market value, while Apple continues to trade at a very modest 15 times earnings.

Is AAPL stock as good of an investment as it was a year ago? No, the stock price growth has started to match (even exceed) earnings growth. But at 15 times earnings, AAPL is still a pretty good deal. Apple will struggle to keep up with demand for the iPhone in the next quarter, and if the rumors are true of a new iPad mini, then they will likely continue to increase profits. Most analysts forecast growth greater then 20% for next year, and TRG does not see any major issue with Apple meeting or exceeding that target.

Longer term, it's harder to say. Apple's products are by far the best designed consumer electronics, but it is always hard to stay on top when everyone is gunning for you. Can Apple create the next big thing without Steve Jobs?

Wednesday, September 19, 2012

Book Review - Debt the First 5000 Years

It is not often that TRG finds a statement about finance and markets that looks at the industry from a totally new prospective and completely broadens the debate.

However, the book 'Debt the First 5000 Years' by David Graeber accomplishes that feat in spades, and goes on to completely shake the foundations of Modern Economic Theory. Graeber is a well respected Anthropologist and also a Wobbly, and an Anarchist. Recently, he has been active with the Occupy movement, and has even been credited (by Rolling Stone Magazine) with coining the statement 'We Are the 99%'.

TRG loves to have his ideas shaken, and Graeber's background makes him well qualified to accomplish that. TRG has been in contact with other anarchists, and has generally found their arguments weak, poorly thought through, and or Utopian. Graeber's book does NOT make an argument for anarchism directly. What it does is show that the current political debate that pits Government vs Markets is nonsense, and probably counter productive. We need to start asking bigger questions.

The book starts with an analysis of the founding principles of Economics. At it's core, Economics has a creation myth, and the book rather effectively attacks this myth. The creation myth of economics is that markets grew naturally as an efficiency improvement over barter based systems. According to Graeber, Anthropologists have long had a major problem with this idea because they have NEVER been able to find evidence of any society that ever existed on anything like the barter system as Adam Smith (and every entry level Economics book) describes it. Graeber lays the arguments out effectively, and although he generally does so in a calm, academic way, don't be fooled. For Economists, attacking Smith this way is a bit like telling the Pope that Jesus was a serial killer!

Graeber goes on to debate that our money system is really an abstraction who's existence only works because of an implicit (and sometimes explicit) threat of violence.

It is really fascinating stuff! TRG is not totally swayed by all the arguments in the book, and he has not been turned into an anarchist by reading it, but it certainly opens a great debate, and asks the right questions.

If you still need further convincing to read the book, there is this interview with Graeber... enjoy:

Monday, September 10, 2012

Fault Lines - The Economist

TRG would like to thank The Economist for doing a guest post this week... OK, not exactly, but the leader 'Tick Tock' in this weeks edition basically hits on all the topics that should be listed here. It was awfully nice of them to come through when TRG had taken such a low profile for August. Funny, but being retired does not seem to preclude an August break!

One Addition

France is still waiting for word on their credit rating from Fitch and Moody's. Considering that they have been on negative review since December (Fitch) and October (Moody's) of last year the verdict should be out soon. Moody's has recently become more negative on Europe so it's hard to imagine that they will have nice things to say for France. It seems likely that the news will not be good, and as TRG has pointed out before, this could lead to trouble.

One Addition

France is still waiting for word on their credit rating from Fitch and Moody's. Considering that they have been on negative review since December (Fitch) and October (Moody's) of last year the verdict should be out soon. Moody's has recently become more negative on Europe so it's hard to imagine that they will have nice things to say for France. It seems likely that the news will not be good, and as TRG has pointed out before, this could lead to trouble.

Thursday, August 9, 2012

Crime and Banking

That Retired Guy (TRG) has already posted about banking culture and how it has created the latest mess. In that post, he emphasized how banking culture had degraded to a point where fiduciary duty became a quaint joke, he also eluded to the presence of fraud and corruption. We are now learning about some of the horrendous crimes that came as a result (for example, see here and here, or just look at this post from The Big Picture). It should come as no surprise really when you think about the culture that was cultivated over the last 30 years in banking.

In TRG's opinion, the future will bring us a banking industry that once again becomes mundane, as it was in the 1950's or 1960's. It will likely take some major regulatory changes to achieve this, but the public outcry and Dodd Frank Act have shown that it CAN happen (even if, so far, there has not been nearly enough done so far). In a way, the fact that we are even hearing about serious and systematic lawbreaking by the banks is a result of a change in public mood that no longer allows the regulators to quietly accept a fine and forget about everything they discover.

Of course the criminal behavior has been going on for years, and the regulators have frequently uncovered it, but the standard practice was to quickly settle with the bank. The settlements allowed for a reasonable sized fine (banks have paid billions) but the banks were allowed to deny guilt, and most importantly, avoid making the details of the transgression public.

Things are slowly changing. The public mood has now come to see banking for what it is, and that is pushing the regulators to do their jobs. In banking speak, the regulators are "growing a pair of balls", and latest action by Benjamin M. Lawsky against Standard Chartered Bank is a great example. Another example is Judge Jed S. Rakoff (a TRG hero) and his rejection of the settlement with Citibank.

TRG is thrilled to see the tide changing, but disappointed that the change is not faster. There are lots of people who should be behind bars, but even that is not enough. The regulation must change, DRASTICALLY (Dodd Frank is not enough).

In TRG's opinion, the future will bring us a banking industry that once again becomes mundane, as it was in the 1950's or 1960's. It will likely take some major regulatory changes to achieve this, but the public outcry and Dodd Frank Act have shown that it CAN happen (even if, so far, there has not been nearly enough done so far). In a way, the fact that we are even hearing about serious and systematic lawbreaking by the banks is a result of a change in public mood that no longer allows the regulators to quietly accept a fine and forget about everything they discover.

Of course the criminal behavior has been going on for years, and the regulators have frequently uncovered it, but the standard practice was to quickly settle with the bank. The settlements allowed for a reasonable sized fine (banks have paid billions) but the banks were allowed to deny guilt, and most importantly, avoid making the details of the transgression public.

Things are slowly changing. The public mood has now come to see banking for what it is, and that is pushing the regulators to do their jobs. In banking speak, the regulators are "growing a pair of balls", and latest action by Benjamin M. Lawsky against Standard Chartered Bank is a great example. Another example is Judge Jed S. Rakoff (a TRG hero) and his rejection of the settlement with Citibank.

TRG is thrilled to see the tide changing, but disappointed that the change is not faster. There are lots of people who should be behind bars, but even that is not enough. The regulation must change, DRASTICALLY (Dodd Frank is not enough).

Thursday, July 19, 2012

Fault Lines - Strangely Calm

That Retired Guy (TRG) spent a few weeks away from the blog, but he's back now. In the time that he was gone, a strange calm settled into the markets. It is strange because the overall picture has probably become more troubling even if the terms for Spain seemed more acceptable. The Spanish bank bailout exposed a new dynamic in the European political landscape. France can no longer be expected to march to Germany's orders. Now, Francios Hollande has become a sort of kingmaker, and he seems keen to make anyone but Angela Merkel king. In the last round he sided with Mariano Rajoy, and Mario Monti but in future rounds, it's harder to predict.

So the last few weeks have created yet more uncertainty for the future. Certainly, the problems have not become any less urgent, but the solutions are even more remote. So where are the fault lines for the next few weeks? The may reside in surprising places:

Watch The Budgets and Forecasts

It is now mid summer, mid year, and the next round of GDP and budget forecasts will be on the way soon for most of Europe. The expectations are low, and TRG expects that there will be no positive surprises. The reason this is a fault line, is that serious issues can (and probably will) be exposed even without negative surprises. In Greece for example, it will probably start to become clear that even more bailout money would be required to end the crisis. France, Spain and Italy each stand a serious risk of looking weak in the numbers, and any one of them can easily set off another catastrophe. Although less likely, even Germany could have bad numbers. Basically, over the next few weeks, there will likely be problems unless every country in Europe surprises to the up side, and that is certainly very unlikely.

LIBOR Fraud

This is not exclusively a European problem , but the fault line here is so broad for the banking industry that Europe can not possibly be excluded from the trouble. It may take more then a few weeks for this pot to really boil over, however the heat has been on 'high' for a while now, and it just gets more and more dangerous. As Bloomberg notes, the real problems will come when the banks start to fight each other. Any bank involved in fudging LIBOR (or any other benchmark rate) will face a horrible one sided liability problem. The problem is that they will be sued by every injured party, but they will have no way of claiming from parties who benefited from the fraud. The potential liability is huge, hard to calculate, and likely to start showing up in the next quarters results. European banks desperately need profits to repair their balance sheets, so a big LIBOR problem could easily snowball.

So the last few weeks have created yet more uncertainty for the future. Certainly, the problems have not become any less urgent, but the solutions are even more remote. So where are the fault lines for the next few weeks? The may reside in surprising places:

Watch The Budgets and Forecasts

It is now mid summer, mid year, and the next round of GDP and budget forecasts will be on the way soon for most of Europe. The expectations are low, and TRG expects that there will be no positive surprises. The reason this is a fault line, is that serious issues can (and probably will) be exposed even without negative surprises. In Greece for example, it will probably start to become clear that even more bailout money would be required to end the crisis. France, Spain and Italy each stand a serious risk of looking weak in the numbers, and any one of them can easily set off another catastrophe. Although less likely, even Germany could have bad numbers. Basically, over the next few weeks, there will likely be problems unless every country in Europe surprises to the up side, and that is certainly very unlikely.

LIBOR Fraud

This is not exclusively a European problem , but the fault line here is so broad for the banking industry that Europe can not possibly be excluded from the trouble. It may take more then a few weeks for this pot to really boil over, however the heat has been on 'high' for a while now, and it just gets more and more dangerous. As Bloomberg notes, the real problems will come when the banks start to fight each other. Any bank involved in fudging LIBOR (or any other benchmark rate) will face a horrible one sided liability problem. The problem is that they will be sued by every injured party, but they will have no way of claiming from parties who benefited from the fraud. The potential liability is huge, hard to calculate, and likely to start showing up in the next quarters results. European banks desperately need profits to repair their balance sheets, so a big LIBOR problem could easily snowball.

Wednesday, July 18, 2012

Fixing Banking

The banking industry is broken. That Retired Guy (TRG) is hard pressed to find anyone who will defend the industry, but just in case there are some readers who don't think that the banking industry is broken, read this, and this. The question now should be 'how do we fix it?', but unfortunately, there has not been much discussion in this area. TRG actually thinks that just 3 simple, easy to enact laws would completely rectify nearly all of the issues.

1. Separate Commercial Banking From Investment Banking

It is time to re-enact the bits of the Glass-Steagall Act that separated commercial and investment banking. It is very simple, commercial banking should include only the following activity:

2. Mandate That All Commercial Banks Must Be Mutual In Structure

Structure matters. In a mutual structure, the bank is owned by it's depositors. This aligns the interests of the organisation with the people who most need the organisation's care and protection. Mutual banking works, and it exists today in a multitude of credit union organisations. Generally, they are service oriented, and very conservative in their investments. There have been problems with credit unions (usually frauds, but that happens in commercial banks too), however, credit unions have NEVER come anywhere near the problems that corporate commercial banks have created.

3. Mandate That Investment Banks (Hedge Funds Included) Must Be Partnerships In Structure

Partnerships require the managers to own the company completely. When senior managers become partners, they are required to purchase their partnership share, and therefore, they have a lot (usually nearly all) of their net worth tied to the success of the company. The investment banks were generally all partnerships before the early nineties, and it worked to keep them small (it's harder to raise capital from a small group of partners then broader corporate shareholders) and risk adverse (partners worried more about risk because the structure provides the ultimate claw back).

1. Separate Commercial Banking From Investment Banking

It is time to re-enact the bits of the Glass-Steagall Act that separated commercial and investment banking. It is very simple, commercial banking should include only the following activity:

- Taking deposits and servicing depositors

- Investing in conservative loans mostly held to maturity

- Providing other basic consumer financial services such as credit cards

2. Mandate That All Commercial Banks Must Be Mutual In Structure

Structure matters. In a mutual structure, the bank is owned by it's depositors. This aligns the interests of the organisation with the people who most need the organisation's care and protection. Mutual banking works, and it exists today in a multitude of credit union organisations. Generally, they are service oriented, and very conservative in their investments. There have been problems with credit unions (usually frauds, but that happens in commercial banks too), however, credit unions have NEVER come anywhere near the problems that corporate commercial banks have created.

3. Mandate That Investment Banks (Hedge Funds Included) Must Be Partnerships In Structure

Partnerships require the managers to own the company completely. When senior managers become partners, they are required to purchase their partnership share, and therefore, they have a lot (usually nearly all) of their net worth tied to the success of the company. The investment banks were generally all partnerships before the early nineties, and it worked to keep them small (it's harder to raise capital from a small group of partners then broader corporate shareholders) and risk adverse (partners worried more about risk because the structure provides the ultimate claw back).

Friday, June 29, 2012

Fault Lines: Is the Banking Bulet Really Dodged?

Fault Lines is That Retired Guy's periodic run down of the Euro dangers on the horizon (next two weeks).

Meltdown in Spain has once again been averted with an agreement to provide direct banking support from the European bailout funds (EFSF and ESM). As usual, the market has cheered, but are the fault lines really all closed?

Watch Out For That French Downgrade

That Retired Guy (TRG) has been very vocal about the risk of a French downgrade from Moodys or Fitch. The direct risks have actually come down a bit because the ECB has been relaxing it's collateral rules so that the rating agencies opinions are less important. However, they will still matter to the market, and also to the guarantees provided to the EFSF. And a downgrade can only be more eminent now that Hollande has made it clear that austerity is not his plan.

TRG is sticking to his prediction that a French 10 Year Government Bond yield of 4% or more would predicate another serious turn in the crisis.

Did They Really Agree? Really?

Today, the markets are very excited about the agreement to allow the bailout funds go directly to Spanish banks. However, the real work is yet to come, and the likelihood that there will be some bickering over the details seems almost certain. If the details have some holes, then the net effect will be disillusionment with Europe's ability to end the crisis, and that in itself may cause problems.

Where's Cyprus?

Cyprus has requested a bailout. Any surprises will make for nasty headlines. Cyprus is a small country, and the bailout funds available are certainly enough plug any Cypric hole, however there is still a change that Cyprus becomes a catalyst for bigger problems.

Angela Against The World

Angela Merkel had a rough night. First, her German boys got ejected from the Euro 2012 Tournament, and she found herself facing a united front of meek governments demanding easier crisis terms. She buckled, and so this morning, the markets are once again inspired by hope that the latest measures will put an end to the crisis.

Angela must miss her old friend Nic. Hollande has been boosted with a surprisingly strong mandate in France, and is now leading the revolutionary cry against austerity. So far, Angela has maintained her support in Germany in spite of a number of political u-turns, but will the German public really tolerate France's insubordination?

That Retired Guy predicted a slightly different form of Merkeland when Hollande was elected. It's still a little too early to say weather 'Angela Against The World' is the new normal, but even if it is, the big question today (considering the market's move up):

Is 'Angela Against The World' really such a good thing?

Saturday, June 16, 2012

Spain's Problems Were Made by the ECB in Greece

Spain's banking bailout last week has been less then successful, but the blame has not managed to get to the responsible party. There is little question that Spain's problems stem from the property bust, and resulting banking crisis. Spain has not helped it's cause by acting as if the banking problem could be solved without state support. However, considering that the problem is a banking crisis, and the 100 Billion Euro bailout should be sufficient to recapitalize the banks, it is curious that the bond market's judgement of Spain is so harsh. The 10 year government bond for Spain crossed 7% on Thursday. If Spain is forced to pay that rate for long, then a full bailout will be required. So why does the Spanish banking bailout appear to be such a failure? The answer lies with the ECB, and the way they handled the Greek debt restructuring.

Europe's handling of Greece has been a comedy of errors, but possibly the biggest error or all was the ECB's idiotic insistence that they be spared the effects of the debt restructuring. When Greece restructured their private bonds on April 25th the ECB had held approximately 50 Billion of the bonds which they had bought in the open market in an earlier effort to support bond prices. The bonds that the ECB owned were the same bonds that were being restructured, and the long standing legal principle of Pari Passu states that ALL bondholders (including the ECB) must be treated equally. The ECB didn't like this idea, and pulled an audacious, illegal kludge to insure that their bonds would be treated differently. The did this by exchanging their bonds for new ones, but since this treatment was not offered or granted to any other bondholders, it was an absolute travesty. The outrage was muted because the other bondholders (mostly European banks) are so beholden to the ECB that they did not want to bite the hand that props them up. However, just because no one complains does not make it right.

Additionally, just because they thought they got away with it in Greece does not mean that they actually did. Today, we see the fallout of the ECB's behavior in Spain. The banking bailout should have been enough to calm the market, but it only made things worse. Bondholders of Spanish debt understand that they are implicitly subordinated whenever official support is provided. The subordination can be legal (in the case of the ESM) but the real concern is the illegal kind. The precedent has been set, and it states that in a pinch the ECB will change the rules in their favor at the last minute. How the rules get changed is unknown, all that can be certain is that it will be to the detriment of anyone holding Spanish debt.

The ECB is getting their comeuppance, and it's poetic justice in a way, only it's a shame that Spain and the Euro will suffer for the ECB's poor judgement.

Europe's handling of Greece has been a comedy of errors, but possibly the biggest error or all was the ECB's idiotic insistence that they be spared the effects of the debt restructuring. When Greece restructured their private bonds on April 25th the ECB had held approximately 50 Billion of the bonds which they had bought in the open market in an earlier effort to support bond prices. The bonds that the ECB owned were the same bonds that were being restructured, and the long standing legal principle of Pari Passu states that ALL bondholders (including the ECB) must be treated equally. The ECB didn't like this idea, and pulled an audacious, illegal kludge to insure that their bonds would be treated differently. The did this by exchanging their bonds for new ones, but since this treatment was not offered or granted to any other bondholders, it was an absolute travesty. The outrage was muted because the other bondholders (mostly European banks) are so beholden to the ECB that they did not want to bite the hand that props them up. However, just because no one complains does not make it right.

Additionally, just because they thought they got away with it in Greece does not mean that they actually did. Today, we see the fallout of the ECB's behavior in Spain. The banking bailout should have been enough to calm the market, but it only made things worse. Bondholders of Spanish debt understand that they are implicitly subordinated whenever official support is provided. The subordination can be legal (in the case of the ESM) but the real concern is the illegal kind. The precedent has been set, and it states that in a pinch the ECB will change the rules in their favor at the last minute. How the rules get changed is unknown, all that can be certain is that it will be to the detriment of anyone holding Spanish debt.

The ECB is getting their comeuppance, and it's poetic justice in a way, only it's a shame that Spain and the Euro will suffer for the ECB's poor judgement.

Friday, June 15, 2012

Hempton is a Brave Man

Fellow finance blogger and surfer John Hempton has been investigating and exposing Chinese frauds for some time now, but his latest post raises the bar quite substantially:

The Macroeconomics of Chinese kleptocracy

Were it not for his impressive record of finding fraud, his recent post would be easily dismissed, but That Retired Guy (TRG) thinks he may actually be on to something.

The real surprise is that he is willing to come out with something so inflammatory in the first place. China is a pretty nationalistic place, and if he is right in his post, it is also the largest, richest mafia organization in history. He is hitting at the core of what is likely to be seen as THE most sensitive issue for the nation. At very least, Hempton can probably expect his computers to be hacked, and at worst, you can't eliminate the possibility of becoming personally hacked-up or otherwise coming to a violent end! So, TRG says 'hat's off' for speaking truth to power, and if not actual truth, then 'hat's off' for having the guts to say it anyway.

His main premise is that China works because the captive population is forced to save an negative rates, and this gives the thieves in power room to steal and still look like a successful economy. It's true enough, although TRG suspects that most Chinese bureaucrats and SOE employees (at least the low level ones) probably have a firm conviction that they are doing the right thing for their country. Not that their conviction matters per-se, in fact, that may be the reason the the whole fraud works.

The problem with macroeconomics is that there is generally little, or no predictive value to it. Knowing that China will blow up someday does not tell me what to do tomorrow. Furthermore, when China does blow up, the macroeconomic story will still be a background issue, and the thing that really gets the ball rolling will be some sort of event.

Macroeconomics are a bit like the stage design in a theater production. The theme of the stage certainly contributes to the feeling of the play, but it does not direct the plot in the way that the dialog, or action does. Even if China is the biggest fraud ever, it can still get much bigger. It could even grow to become the first world empire before things collapse.

TRG doubts Hempton would refute this, for example, it's unlikely that he has found a way to make a financial wager on the macroeconomic story. Of course, that doesn't make the macroeconomic story any less interesting.

The Macroeconomics of Chinese kleptocracy

Were it not for his impressive record of finding fraud, his recent post would be easily dismissed, but That Retired Guy (TRG) thinks he may actually be on to something.

The real surprise is that he is willing to come out with something so inflammatory in the first place. China is a pretty nationalistic place, and if he is right in his post, it is also the largest, richest mafia organization in history. He is hitting at the core of what is likely to be seen as THE most sensitive issue for the nation. At very least, Hempton can probably expect his computers to be hacked, and at worst, you can't eliminate the possibility of becoming personally hacked-up or otherwise coming to a violent end! So, TRG says 'hat's off' for speaking truth to power, and if not actual truth, then 'hat's off' for having the guts to say it anyway.

His main premise is that China works because the captive population is forced to save an negative rates, and this gives the thieves in power room to steal and still look like a successful economy. It's true enough, although TRG suspects that most Chinese bureaucrats and SOE employees (at least the low level ones) probably have a firm conviction that they are doing the right thing for their country. Not that their conviction matters per-se, in fact, that may be the reason the the whole fraud works.

The problem with macroeconomics is that there is generally little, or no predictive value to it. Knowing that China will blow up someday does not tell me what to do tomorrow. Furthermore, when China does blow up, the macroeconomic story will still be a background issue, and the thing that really gets the ball rolling will be some sort of event.

Macroeconomics are a bit like the stage design in a theater production. The theme of the stage certainly contributes to the feeling of the play, but it does not direct the plot in the way that the dialog, or action does. Even if China is the biggest fraud ever, it can still get much bigger. It could even grow to become the first world empire before things collapse.

TRG doubts Hempton would refute this, for example, it's unlikely that he has found a way to make a financial wager on the macroeconomic story. Of course, that doesn't make the macroeconomic story any less interesting.

Sunday, June 10, 2012

Fault Lines - Now it Gets Political

Fault Lines is That Retired Guy's weekly run down of the Euro dangers on the horizon (next two weeks).

What a difference a week makes. Last week, the main concern was banking, and to a degree, it remains, but the Spanish move to ask for a bailout for it's banks is likely to reduce the chance of a run at least in that country, and there were no major issues coming out of the Greek banks last week, so for the next two weeks politics will play center stage.

Hollande is Likely to Cement His Position, Is That a Good Thing?

The issue with French elections is that they have been surprisingly good at ignoring the elephant in the room. France does not see itself as an overburdened debt country with too generous of a state, and a aging, growth starved economy. In fact, evidenced by their bond rate, the rest of the world doesn't see France that way either. Unless of course you actually ASK someone. In that case, you will here some version of French troubles that include too much debt, too little growth, an aging population, a overly generous state and (especially if you ask an American) a tendency of the population to not work very much. This is a curious condition... TRG is used to seeing cases where perception and reality have become disjointed, but in France, we have a case where perception has in fact become disjointed from perception! Nowhere is this more apparent then on the French political stage where the issues are widely acknowledged, and yet somehow completely ignored in policy proposals.

Were Europe not in such a mess, France's identity crisis could probably continue for years, however...

So what are the risks for Europe coming from France. It seems likely that Francois Hollande will take another victory for his party by packing the parliament with his party. He has played his cards perfectly since the presidential election, and he is surprisingly popular going into the parliamentary election. The problem for Hollande is that there are wolves stalking. Moody's and Fitch seem very ready to downgrade France, and probably they are just waiting for the end of the election cycle so as not to give an appearance of taking a political angle. Things are playing out almost exactly as TRG himself had predicted (and yes, he is very surprised whenever that happens).

The crack that will open to engulf France is not the election, it is the downgrade (see 'Merkelland' for a full description why). The downgrade may not be in the next two weeks, but TRG sees the election as a significant step in the process.

Greek Politics

The upcoming Greek election is such an obvious fault line, that TRG isn't even going to delve into it deeply hear apart from saying that another Greek deadlock is almost certain. With Greece running out of money, and the Troika looking for any excuse not to give more, things are bound to come to a head.

The Cyprus Bailout

TRG expects a bailout to be announced for Cyprus in the next few weeks, and this could unsettle markets. Cyprus is small, so a bailout will be hay rather then a haystack, but there is a real risk that we are coming to the straw that breaks the camel's back.

A Banking Surprise is Still Ever Threatening

TRG is probably going to stop talking about this particular Fault Line, but not because it is going away. Rather, it is so ever present that he is going to get tired of mentioning it. See the last Fault Lines post for a description. Needless to say, it could happen in the next two weeks.

What a difference a week makes. Last week, the main concern was banking, and to a degree, it remains, but the Spanish move to ask for a bailout for it's banks is likely to reduce the chance of a run at least in that country, and there were no major issues coming out of the Greek banks last week, so for the next two weeks politics will play center stage.

Hollande is Likely to Cement His Position, Is That a Good Thing?

The issue with French elections is that they have been surprisingly good at ignoring the elephant in the room. France does not see itself as an overburdened debt country with too generous of a state, and a aging, growth starved economy. In fact, evidenced by their bond rate, the rest of the world doesn't see France that way either. Unless of course you actually ASK someone. In that case, you will here some version of French troubles that include too much debt, too little growth, an aging population, a overly generous state and (especially if you ask an American) a tendency of the population to not work very much. This is a curious condition... TRG is used to seeing cases where perception and reality have become disjointed, but in France, we have a case where perception has in fact become disjointed from perception! Nowhere is this more apparent then on the French political stage where the issues are widely acknowledged, and yet somehow completely ignored in policy proposals.

Were Europe not in such a mess, France's identity crisis could probably continue for years, however...

So what are the risks for Europe coming from France. It seems likely that Francois Hollande will take another victory for his party by packing the parliament with his party. He has played his cards perfectly since the presidential election, and he is surprisingly popular going into the parliamentary election. The problem for Hollande is that there are wolves stalking. Moody's and Fitch seem very ready to downgrade France, and probably they are just waiting for the end of the election cycle so as not to give an appearance of taking a political angle. Things are playing out almost exactly as TRG himself had predicted (and yes, he is very surprised whenever that happens).

The crack that will open to engulf France is not the election, it is the downgrade (see 'Merkelland' for a full description why). The downgrade may not be in the next two weeks, but TRG sees the election as a significant step in the process.

Greek Politics

The upcoming Greek election is such an obvious fault line, that TRG isn't even going to delve into it deeply hear apart from saying that another Greek deadlock is almost certain. With Greece running out of money, and the Troika looking for any excuse not to give more, things are bound to come to a head.

The Cyprus Bailout

TRG expects a bailout to be announced for Cyprus in the next few weeks, and this could unsettle markets. Cyprus is small, so a bailout will be hay rather then a haystack, but there is a real risk that we are coming to the straw that breaks the camel's back.

A Banking Surprise is Still Ever Threatening

TRG is probably going to stop talking about this particular Fault Line, but not because it is going away. Rather, it is so ever present that he is going to get tired of mentioning it. See the last Fault Lines post for a description. Needless to say, it could happen in the next two weeks.

Thursday, June 7, 2012

The Market's Up, But Don't Let That Fool You

To the casual observer, the market performance over the last few days would suggest that things have changed dramatically. That Retired Guy (TRG) is not so sure. The Fault Lines in the Euro certainly have not become any less precarious. Of course there has been market commentary linking the moves in the market to the prospect of direct capital injection into Spain's banks from the European Union. TRG is not convinced about this either.

The fact is that on any given day, it's damn hard to explain what the market is doing with the actual facts of world events. In the latest news, there are two New York Times articles that demonstrate that things are still pretty bad in Spain and Greece:

Greece Going Broke

The title say's it all. Greece is running out of money, and the EU is not going to be happy about providing more.

Spain Holds Trump Card

This article puts a positive spin on the idea that Spain will enter bailout negotiations with a strong bargaining position. It's true enough, but TRG fails to see how difficult negotiations are somehow a good thing, as if the situation in Greece, Ireland, and Portugal would have somehow been better if the bail out countries had gotten a better deal for themselves. The fact is that German voters will NEVER think that the PIIGS are doing enough, and the PIIGS will ALWAYS think the austerity is too extreme.

So the market's up, but the storm clouds are as dark as ever.

The fact is that on any given day, it's damn hard to explain what the market is doing with the actual facts of world events. In the latest news, there are two New York Times articles that demonstrate that things are still pretty bad in Spain and Greece:

Greece Going Broke

The title say's it all. Greece is running out of money, and the EU is not going to be happy about providing more.

Spain Holds Trump Card

This article puts a positive spin on the idea that Spain will enter bailout negotiations with a strong bargaining position. It's true enough, but TRG fails to see how difficult negotiations are somehow a good thing, as if the situation in Greece, Ireland, and Portugal would have somehow been better if the bail out countries had gotten a better deal for themselves. The fact is that German voters will NEVER think that the PIIGS are doing enough, and the PIIGS will ALWAYS think the austerity is too extreme.

So the market's up, but the storm clouds are as dark as ever.

Tuesday, June 5, 2012

Fault Lines - Watchout for the Banks

Europe is in a mess at the moment. The once sturdy Euro has suffered some substantial blows, and a lattice of cracks have appeared in the foundation. TRG has (belatedly) come around to the idea that Greece will leave the Euro, which immediately raises the question 'what will happen to the Euro then?' Exit for Greece is bound to be messy, and the politicians have shown over and over again that they are incapable of getting in front of this crisis. If Greece leaves, then that is likely to trigger more events that will spread pain through Europe, and the world. However, Greece leaving the Euro may not even be the first event. Clearly, we are no longer talking exclusively about Greece when we discuss threats to the Euro, and TRG believes that limiting the discussion to even Portugal, Italy, Ireland, Greece and Spain (PIIGS) is too narrow. The cracks in the Euro spread far wider, for example, a credit rating downgrade in France could easily spark another moment of deep crisis.

'Fault Lines' will be a regular feature on the That Retired Guy blog, hopefully once every week or so. The idea is to look at the coming two weeks and suggest what seem to present the Euro threats. These threats are sure to change overtime, and TRG is hoping to chronicle where we are in each step.

Running (on) the Banks

The most likely catalyst for the next crisis would be if the current slow motion 'Bank jog' turned in to a full scale 'Bank Run' in Spain or Greece. The smart money (corporate deposits of international companies) has likely already left these countries, and individual deposits are slowly leaking out too.

All banks have an implicit risk of becoming insolvent if depositors all ask for their money at once. Typically, this happens when a roomer circulates that the bank is going to fail and anyone who does not get their money out fast will loose it. If this were to happen to any significantly sized bank in Greece or Spain, it would create an instant Euro crisis, that could easily result in a breakup of the currency.

The sad fact is that some people are being awfully foolish. TRG has read stories of people pulling money out of the banks to keep it in cash at home. Aside from the obvious security risk this creates, it is also completely ineffective as insurance in the event of Euro exit. In an exit scenario, ALL money inside the borders of the country will be re-denominated INCLUDING NOTES AND COINS, the military will secure the border to prevent cash from leaving. So keeping money as cash at home will not protect it. Better to open a bank account in Switzerland, or use the money to buy an asset (such as Bunds) that will continue to be denominated in a currency worth having if the Euro splits. TRG is not a big fan of gold, but it would also work as a short term store of value if the Euro breaks apart.

A Large European Bank (Anywhere) Has A Big Unexpected Loss

JP Morgan recently demonstrated that big banks have not learned any lessons from the past crisis. TRG believes this is no accented, but rather a result of the broken banking culture that continues to fester, and is decaying the banking system from the inside out. If a large European bank (Deutsche Bank is TRG's favorite candidate) suddenly announced that a few billion Euro's had gone missing due to some sloppy risk control, and/or 'rouge' trader then it would set of a shit storm in the market. Deutsche Bank is TRG's favorite candidate for such a misfortune because like JP Morgan in the US they have been a big proponent of the "But our shit doesn't stink!" line of reasoning. The reasoning is that because they survived the last crisis without any major scars, they should be seen as special. Deutsche Bank has a ridiculous leverage ratio, and a weak capital position, one reasonably sized loss is all it will take before they are suddenly looking very shaky, and the fact that the German government would inherit the problem could leave the rest of Europe in a poetically ironic state of schadenfreude. Deutshe Bank is not the only bank that could set off trouble, Societe Generale, Barclays, Unicredit, and Santander have all drunken deeply from the "But our shit doesn't stink!" trough, and any of them would suffer double if an unexpected loss were to come to light now.

The Ever-Present Political Risk

When times are rough, the simplest political mis-step can set off a major problem. We came close last week when Spain's Rajoy suggested Europe help with the Bankia bailout without getting Angela Merkel's take on the idea first. It looks like Europe will be coming to the rescue of Spain's banks regardless but the bullet seems to have been only narrowly dodged (and the Bankia story is not over yet). Political risk could also come on the campaign trail in Greece, although the real political story will be latter in June with the election itself happens.

'Fault Lines' will be a regular feature on the That Retired Guy blog, hopefully once every week or so. The idea is to look at the coming two weeks and suggest what seem to present the Euro threats. These threats are sure to change overtime, and TRG is hoping to chronicle where we are in each step.

Running (on) the Banks

The most likely catalyst for the next crisis would be if the current slow motion 'Bank jog' turned in to a full scale 'Bank Run' in Spain or Greece. The smart money (corporate deposits of international companies) has likely already left these countries, and individual deposits are slowly leaking out too.

All banks have an implicit risk of becoming insolvent if depositors all ask for their money at once. Typically, this happens when a roomer circulates that the bank is going to fail and anyone who does not get their money out fast will loose it. If this were to happen to any significantly sized bank in Greece or Spain, it would create an instant Euro crisis, that could easily result in a breakup of the currency.

The sad fact is that some people are being awfully foolish. TRG has read stories of people pulling money out of the banks to keep it in cash at home. Aside from the obvious security risk this creates, it is also completely ineffective as insurance in the event of Euro exit. In an exit scenario, ALL money inside the borders of the country will be re-denominated INCLUDING NOTES AND COINS, the military will secure the border to prevent cash from leaving. So keeping money as cash at home will not protect it. Better to open a bank account in Switzerland, or use the money to buy an asset (such as Bunds) that will continue to be denominated in a currency worth having if the Euro splits. TRG is not a big fan of gold, but it would also work as a short term store of value if the Euro breaks apart.

A Large European Bank (Anywhere) Has A Big Unexpected Loss

JP Morgan recently demonstrated that big banks have not learned any lessons from the past crisis. TRG believes this is no accented, but rather a result of the broken banking culture that continues to fester, and is decaying the banking system from the inside out. If a large European bank (Deutsche Bank is TRG's favorite candidate) suddenly announced that a few billion Euro's had gone missing due to some sloppy risk control, and/or 'rouge' trader then it would set of a shit storm in the market. Deutsche Bank is TRG's favorite candidate for such a misfortune because like JP Morgan in the US they have been a big proponent of the "But our shit doesn't stink!" line of reasoning. The reasoning is that because they survived the last crisis without any major scars, they should be seen as special. Deutsche Bank has a ridiculous leverage ratio, and a weak capital position, one reasonably sized loss is all it will take before they are suddenly looking very shaky, and the fact that the German government would inherit the problem could leave the rest of Europe in a poetically ironic state of schadenfreude. Deutshe Bank is not the only bank that could set off trouble, Societe Generale, Barclays, Unicredit, and Santander have all drunken deeply from the "But our shit doesn't stink!" trough, and any of them would suffer double if an unexpected loss were to come to light now.

The Ever-Present Political Risk

When times are rough, the simplest political mis-step can set off a major problem. We came close last week when Spain's Rajoy suggested Europe help with the Bankia bailout without getting Angela Merkel's take on the idea first. It looks like Europe will be coming to the rescue of Spain's banks regardless but the bullet seems to have been only narrowly dodged (and the Bankia story is not over yet). Political risk could also come on the campaign trail in Greece, although the real political story will be latter in June with the election itself happens.

Thursday, May 31, 2012

Some Day, 'Financial Innovation' Will Once Again be an Oxymoron

That Retired Guy (TRG) is a refugee of the world of high finance. His career spanned 15 years mostly in New York and London. TRG saw a lot in those 15 years. Most of that time, finance was a celebrated industry, and in the glory days, it was hard not to swallow some of the cool-aid. Now, with the benefit of hindsight, TRG can see that the rot had started long before the crisis of 2008 exposed it to the outside world. Like a zit on the face of the globe, the puss built up below the skin even when the outside world thought everything was beautiful. When the painful zit-head finally appeared, the full extent of the problem was still hidden. But when agitated, the puss exploded everywhere. Of course, this 'zit' analogy only really works if you've seen John Bolushi's zit joke in the movie Animal House. That's the short story of the downfall of finance in the last 20 years (put in terms that any adolescent can easily understand). For anyone interested in what really happened, read on.

It Started With a Little Lie About Efficient Markets

This story starts a few years (maybe a decade) before TRG hit the financial scene. At the time (and even today to a certain degree) the Efficient Market Theory was seen as a hard to refute fact. Those in the world of Finance certainly were (most still are) big believers. Bankers then and now often fall back on the idea of Efficient Markets as a raison d'être. The logic goes something like this: the market is efficient, so if someone is paying for a financial innovation, then it must be valuable to them, and by extension society overall. Loyd Blankfien famously pushed that button when he said he Goldman Sachs was doing "gods work". The idea Loyd was hitting on was that financial innovation was making the world of capital allocation more efficient, and this increased efficiency was a benefit to all humanity. This is of course, NONSENSE, but it's that dangerous sort of nonsense that sounds nice, and is easy to follow.

After what we have experienced in the last 3.5 years (and are still experiencing today) the idea that financial innovation is making the world better should be a hard sell, but it seems some people still take it for granted. The academic debate will rage for years. Academia is particularly fond of the idea of Efficient Markets, but the theory actually suggest that corruption and fraud are market inefficiencies which will be resolved 'naturally' as long as markets are free and transparent. Anyone who has ever worked in an investment bank knows that 'transparent' financial markets are a useful illusion used to distract the client's attention while you get extra revenue from some part of the process that is left surprisingly opaque.

The truth is that the world of finance is subject to fashion, trend and hype; in fact, it seems that most every human endeavor is. Years of calm markets created a complacent public who believed that the smart folks in finance had finally figured out how to create profitable, never ending stability. Opaque, hard to analyze products, aggressively sold by bankers who present an illusion of providing an 'inside track' came in contact with a willing public allowing the promise of quick profits to dampen their natural skepticism.

Banks create new products because they can SELL them. This statement seems painfully obvious, but it deserves a deeper look. Note that the only important aspect is that a sale can be made, not that the sale is beneficial for the client. Efficient market theory tells us that the sale itself is evidence that the product is beneficial, but TRG has witnessed first hand that the benefit of the client is a secondary concern to the banker, and in fact, it is often absent.

Paul Volcker hit the nail on the head when he said that the only useful financial innovation in the past 25 years was the ATM. Lord Adair Turner said that most financial innovation was "socially useless" which is probably being generous because it does not account for some innovation actually being socially damaging. TRG has a humble idea that he believes will easily illustrate that the growth in the finance industry is NOT improving the world. It's a simple idea, the premise is this: if the financial industry is good for the world then growth in financial profits should be matched in overall corporate profit growth, and in fact global GDP growth.

The Finance Industry is Actually a Tax on Investment

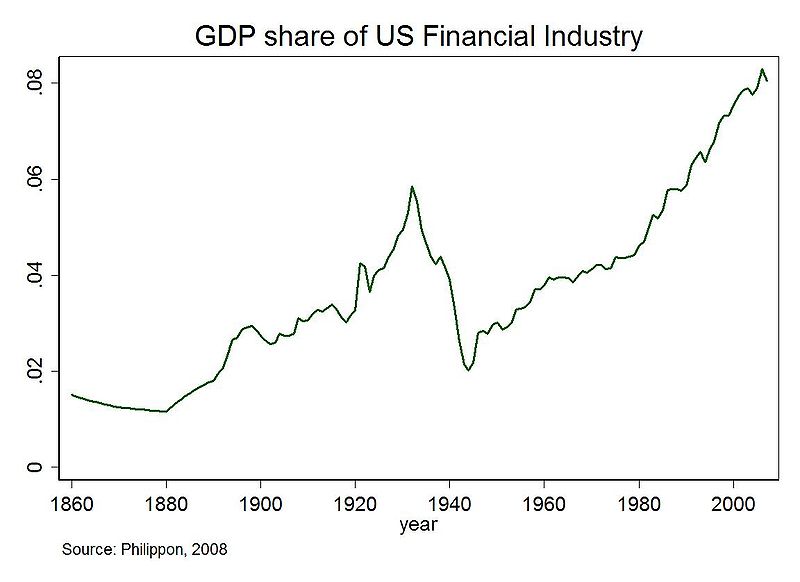

Finance is a service, and ideally, it is a contributing service to other useful economic activity. However, finance is a specific kind of service, at it's core, the job of the financial industry is simple: take excess capital (savings) and deploy it in useful ways (investment). Finance moves money from savings to investment, and takes a little slice of that money as a fee for the service. The fee is an important element here because in a perfectly efficient system savings and investment would come together without the need for a financial industry to help them. When finance takes it's fee, what is really happening is that a small amount of investment money is leaking out of the system and resulting in less investment then if the investment had happened without the financial industry getting involved. In a way, the financial industry's cut can be seen as a sort of 'tax' on investment. Everything is fine with that, if the financial fee (tax) is really compensating for a truly enabling activity, then it is worth paying. Over time, this should become evident because when financial fees increase, overall economic activity that they are promoting should increase more. The problem is that in fact, the finance industry has been taking a bigger and bigger slice of the pie. TRG doesn't have the global numbers, but he was able to find the numbers for the US (courtesy of wikipedia who sourced it from here):

Unfortunately, the global equivalent of this graph is required to prove the point. Back in the day when This Retired Guy was That Working Guy, he could have grabbed this data from his Bloomberg terminal (maybe not going back 150 years, but certainly they have some data) to show the same trend. TRG would really appreciate if one of his readers is plugged into a Bloomberg terminal and can help.

The global numbers are necessary because the above graph could result from the US doing more finance for OTHER countries. TRG doesn't think that's really what's happening here, but until we see the total global financial industry graphed as a percent of global GDP the jury is still out.

Assuming the global graph looks something like the above graph, then it would be a pretty damning indictment of the finance industry. The fee (tax) going to finance has gone up from less then 2% of economic activity to nearly 8% in the United States in the last 150 years! In itself, this graph does not prove that finance is bad, but it does say that at very least, finance is becoming much LESS effective at helping economic activity then it was. That should be surprising, after all, the banking industry benefited greatly from improvements in computers, and telecommunication over this time. Why has finance not become more efficient at it's central job of enabling investment?

The Masters of the Universe Have Taken Over

Most of the money that the finance industry earns (from taxing investments) goes to pay staff, compensation ratios (percent of pay to overall revenue) very but generally run 30 to 40%. This is not surprising in itself, but when you couple this fact with the revelation that the financial industries revenue is actually a tax on investment, then it starts to become clear how we got into this mess.

In TRG's time as a finance employee, he saw the industry increasingly attracting the smartest and most driven individuals with the promise of ever increasing pay. When a bright young graduate was being hired, there was an implicit bargain being offered. The bank was basically saying "find a way to increase the tax on investment, and we will share the profit with you". The banks thought they were getting a good deal, but in fact, they missed an important element. The easiest way to increase revenue in finance is to increase risk.

Increasingly, the banks have modeled their culture as a meritocracy. "Make more for the bank, and you will make more for yourself" or in banker jargon "eat what you kill" is an obvious part of that, but pay is only one aspect of the industry's obsession with rewarding on 'merit'. Promotion to management increasingly worked on the same principal. Meritocracy seems like a great way to run a business, but in fact, it has some drawbacks. First, it is critical that the analysis of performance is accurate, and that there is little chance that they system will be 'gamed'. Second, if different job's require different skills, then the 'The Peter Principle' can become a real thing. The Peter Principle is the idea that in a meritocracy, each individual will be promoted until they reach a level where they are incompetent, and there they will remain unable to achieve further promotion. This is particularly troublesome in banking where, for example, the personality traits which seem compatible with successful traders are disastrous when employed in management.

In the golden years, the hyper competitive environment, and difficult working conditions came with a fat paycheck around Christmas time. The personalities that excelled in this environment created a culture which became less and less human, and more ruthless in it's drive for maximum reward. TRG remembers well the common refrain whenever a high flying trader was confronted with anyone who didn't agree with them, or do what they wanted... these individuals had a name in the trader's mind, they were called 'Fucking Idiots'.

When the fire-hose of profits was spraying far and wide, none of this seemed to be an issue, it was even glorified. Financial industry employment itself became a fashion. This process was already well underway when TRG started, but then it really took off. When we say 'banker' today, we envision slick Wall Street types in expensive suits.

The banking crisis of 2008 was a direct result of this culture, and the result was inevitable. Of course, mortgage securities packed with sloppy underwritten loans paid their part, but if it hadn't been Synthetic CDO's then the slick bankers would have come up with something else.

We Need to Get Back to the Old Style Banker

This vision of the modern banker would sound very strange to a man on the street in the 1950's, or in fact, most of history. Historically, banking has been a conservative boring career; a bit like being an accountant but not quite as exciting. This is in fact what banking should be; boring. Bankers should be hyper conservative rather then hyper competitive. They should be custodians of wealth who pride themselves at saying 'no' to everything except the most solid investments. Innovation should be a dirty word in finance! The economy will not grow as fast, but it will be more stable. Today's stereotypical banker is the real reason that things went wrong. Fortunately, the flashy high flying banker of today is an anomaly, not a permanent evolution. The industry is already showing signs of change, but this is just the beginning. The adjustment has started; the old banker is coming back. It took decades for things to get this messed up, so it is going to take time to make it right, and it wont be easy.

Getting to the Old Style Banker Will Be No Fun For the New Style Banker

For the modern day financial professional, this adjustment is going to be particularly painful. They were sold a promise that is no longer valid. There is now pressure to reduce pay and pay is coming down, but the culture change has not even begun, in fact, the culture has become even more poisonous. As the revenue has come down, most of the big banks have also cut back on staff as well as pay. The jobs have not become any less intense, but now there are fewer people to do them. In fact, with the wave of regulation (Dodd-Frank and Basel III to name just a few) the workload has dramatically increased.

There was a fair amount of truth in the old stereotype of banking jobs being unbearably stressful and intense, but justified by the high compensation. That was the old stereotype, now the stereotype is of a job that is unbearably stressful, intense, surrounded by backstabbing assholes, and providing an ever shrinking paycheck. Since staffing levels are down at most banks, this increased work is falling on the remaining employees, at a time when the big compensation packet is no longer in the cards. TRG had his own reasons for leaving the finance industry, but he knows many who are heading for the exit now for this reason.

As the pay pools have dried up, the hyper competitive staff have become increasingly preoccupied with grabbing recognition for anything that has generated positive revenue, and avoiding any work that distracts from increased revenue generation. Naturally, if anything goes wrong, then shifting blame has also become a critical professional skill. What was once a team oriented focus on getting the job done has increasing become an environment of constant witch hunts, and passing the buck. In the last years of TRG's career, he noticed that it was increasingly not good enough to get someone to agree, it had to be written in an e-mail correspondence somewhere because the agreement or promise was likely to be reneged later. The environment was always high pressured, but when you get to a point that people can't be trusted to keep there word, it's really no fun!

In TRG's humble opinion, this is how the world ends for the modern day banker. The job will end because the culture has slowly poisoned itself on it's own glutenous behavior. Bankers are already leaving the industry like rats from a sinking ship (exactly like rats actually). It will take time, but eventually, banks will become boring places full of people who seem to pride themselves on their conservative, bureaucratic routine. 'Banking Innovation' will once again be an oxymoron.

It Started With a Little Lie About Efficient Markets

This story starts a few years (maybe a decade) before TRG hit the financial scene. At the time (and even today to a certain degree) the Efficient Market Theory was seen as a hard to refute fact. Those in the world of Finance certainly were (most still are) big believers. Bankers then and now often fall back on the idea of Efficient Markets as a raison d'être. The logic goes something like this: the market is efficient, so if someone is paying for a financial innovation, then it must be valuable to them, and by extension society overall. Loyd Blankfien famously pushed that button when he said he Goldman Sachs was doing "gods work". The idea Loyd was hitting on was that financial innovation was making the world of capital allocation more efficient, and this increased efficiency was a benefit to all humanity. This is of course, NONSENSE, but it's that dangerous sort of nonsense that sounds nice, and is easy to follow.

After what we have experienced in the last 3.5 years (and are still experiencing today) the idea that financial innovation is making the world better should be a hard sell, but it seems some people still take it for granted. The academic debate will rage for years. Academia is particularly fond of the idea of Efficient Markets, but the theory actually suggest that corruption and fraud are market inefficiencies which will be resolved 'naturally' as long as markets are free and transparent. Anyone who has ever worked in an investment bank knows that 'transparent' financial markets are a useful illusion used to distract the client's attention while you get extra revenue from some part of the process that is left surprisingly opaque.

The truth is that the world of finance is subject to fashion, trend and hype; in fact, it seems that most every human endeavor is. Years of calm markets created a complacent public who believed that the smart folks in finance had finally figured out how to create profitable, never ending stability. Opaque, hard to analyze products, aggressively sold by bankers who present an illusion of providing an 'inside track' came in contact with a willing public allowing the promise of quick profits to dampen their natural skepticism.

Banks create new products because they can SELL them. This statement seems painfully obvious, but it deserves a deeper look. Note that the only important aspect is that a sale can be made, not that the sale is beneficial for the client. Efficient market theory tells us that the sale itself is evidence that the product is beneficial, but TRG has witnessed first hand that the benefit of the client is a secondary concern to the banker, and in fact, it is often absent.

Paul Volcker hit the nail on the head when he said that the only useful financial innovation in the past 25 years was the ATM. Lord Adair Turner said that most financial innovation was "socially useless" which is probably being generous because it does not account for some innovation actually being socially damaging. TRG has a humble idea that he believes will easily illustrate that the growth in the finance industry is NOT improving the world. It's a simple idea, the premise is this: if the financial industry is good for the world then growth in financial profits should be matched in overall corporate profit growth, and in fact global GDP growth.

The Finance Industry is Actually a Tax on Investment